Chapter 1. General Terms

Article 1 (Purpose)

The purpose of these Terms of Use of Services for Electronic Financial Transactions (the “TOU”) is to set forth the rights, obligations and responsibilities of the Users and HUALIAN BIOTECH SDN.BHD. (the “Company”) in relation to the use of the e-Payment Gateway Services, the Payment Escrow Services, and services relating to the issuance and management of the Electronic Pre-payment Means (collectively the “EFT Services”) provided by the Company through the internet websites [the Auction internet open market site (the “Auction Site”) and Beautyshop internet open market site (www.sellbeautyshop.com) (the “Beautyshop Site”)] operated by the Company.

Article 2 (Definitions)

1) Capitalized terms used herein shall have the following meaning:

1. “Electronic Financial Transaction” or “EFT” shall mean any transaction where the Company provides electronic financial service through the Electronic Device (the “Electronic Financial Business”), which is used by the Users in an automated manner without personally appearing before or directly communicating with employees of the Company.

2. “Electronic Payment Means” shall mean an Electronic Pre-payment Means, credit card, or other means of payment through electronic means as defined in Article 2, Section 11 of the Electronic Financial Transactions Act (the “EFTA”).

3. “Electronic Payment Transaction” shall mean any electronic financial transaction whereby a person providing a payment, requires the Company to transfer money to another person receiving the payment (the “Payee”), by Electronic Payment Means.

4. “Electronic Device” shall mean any device used to transmit or process information on the Electronic Financial Transaction through electronic means, such as a cash dispenser, automatic teller machine, debit terminal, computer, telephone, or other devices that electronically transmit or process information.

5. “Means of Access” shall mean any means or information which is used to issue a Transaction Request in the Electronic Financial Transaction or to secure the authenticity and accuracy of Users and the details of such transaction as defined in Article 2, Section 10 of the EFTA, i.e., an electronic card or other electronic information (including credit card information) equivalent thereto; algorithm information used to create an electronic signature and certificate referred to in the Digital Signature Act; user identification number registered with a financial institution or an electronic financial company; biometric data of Users; and any Password required to use any of the foregoing means or information.

6. “EFT Services” shall mean services the Company provides to Users pursuant to Article 4 hereof.

7. “User” shall mean, unless otherwise provided in Chapters 2 through 4, members of the Auction Site and the Beautyshop Site who agree to the TOU and use the EFT Services provided by the Company.

8. “Transaction Request” shall mean any request whereby a user asks a financial institution or an electronic financial company to process the Electronic Financial Transaction pursuant to an EFT agreement.

9. “Error” shall mean any case where an EFT fails to go through pursuant to either an EFT agreement or the User’s Transaction Request without willful misconduct or gross negligence on part of the User.

10. “User Number” shall mean a combination of numbers and letters set by the User and approved by the Company to identify individual Users and use services.

11. “Password” shall mean a combination of numbers and letters set by the User and approved by the Company to identify individual Users and protect information of the members (of the website concerned).

12. “Chain Store” shall mean any person (other than an electronic financial company) who offers goods or services to Users in transactions conducted by using the Electronic Payment Means under a contract with the Company.

2) Any terms not defined herein shall have the meaning provided under the EFTA and other relevant laws and regulations.

Article 3 (Scope, Validity, and Amendment of the TOU)

1) The TOU shall apply if the Users utilize Prepaid Mail-order Sale services through the Auction Site or the Beautyshop Site.

2) The Company shall disclose the TOU on the Auction Site and the Beautyshop Site prior to EFTs being entered into by the Users so that the Users may check important information included in the TOU.

3) The Company shall send a copy of the TOU to a User upon his/her request by transmitting an electronic document (including transmission by email), by facsimile, mail or in-person delivery.

4) If any terms of the TOU are amended by the Company, the amended TOU shall, for one (1) month prior to the TOU taking effect, be (i) posted on the screen that prompts Users to enter their financial transaction information (i.e. order form) and on the Auction Site and the Beautyshop Site and (ii) notified to the Users.

Article 4 (Composition and Details of EFT Services)

1) The EFT Services consist of the following individual services, and the Company shall post details on each service on the Auction Site and the Beautyshop Site.

1. e-Payment Gateway Services;

2. Payment Escrow Services (services for the protection of sales & purchases); and

3. Services relating to the issuance and management of the Electronic Pre-payment Means

2) The Company may add or amend services as necessary by providing prior notification to the Users.

Article 5 (Confirmation of Transaction Details)

1) The Company shall ensure that the User can confirm the details of his/her transactions through the ‘My Auction’ page of the Auction Site and the ‘My Shopping Information’ page of the Beautyshop Site (including the User’s ‘details of the requests for correction of errors and the results of its processing’). If the User requests that the Company provide the transaction details in writing, then the Company shall, within two (2) weeks from the date it received such request, deliver the transaction details in writing by facsimile, mail, or personal delivery.

2) If the Company is unable to provide the transaction details in writing requested by the User due to operational failure of the Electronic Device or other causes, then it shall immediately notify the User of such cause by transmitting an electronic document (including transmission by email). In this case, the period during which the transaction details cannot be provided due to operational failure of the Electronic Device shall not be included in the calculation of the delivery period of the written statement in Paragraph 1) above.

3) Of the transaction details under Paragraph 1) above, the Company must retain the following information for five (5) years:

1. Name or number of transaction account;

2. Type and amount of transaction;

3. Information identifying the counterparty to the transaction;

4. Date and time of transaction;

5. Type of the Electronic Device and information identifying the Electronic Device;

6. Fees that the Company received in connection with EFTs;

7. User consent for the withdrawal of money;

8. Access records of the Electronic Device related to the subject EFT;

9. Request for EFT and change in conditions for the EFT; and

10. Records on EFTs where the transaction amount is at least KRW 10,000 per transaction

4) Of the transaction details under Paragraph 1) above, the Company must retain the following information for one (1) year:

1. Records on de minimis EFTs where the transaction amount is less than KRW 10,000 per transaction;

2. Records regarding approval of transactions in relation to the use of the Electronic Payment Means; and

3. User’s request for correction of Errors, and the result of its processing.

5) The User may request written documents set forth in Paragraph 1) above to the following addresses of each open market site:

1. For the Auction Site

Address: Toona Building 6th Floor, 461 Sang-dong, Wonmi-gu, Bucheon-si, Gyunggi-do

Email address: [email protected]

Phone number: 1588-0184

2. For the Beautyshop Site

Address: Toona Building 6th Floor, 461 Sang-dong, Wonmi-gu, Bucheon-si, Gyunggi-do

Email address: [email protected]

Phone number: 1566-5701

Article 6 (Correction of Errors)

1) When the User becomes aware of an Error in using the EFT Services, he/she may request the Company to correct the Error.

2) When the Company receives a request to correct an Error pursuant to Paragraph ? or becomes aware that there is an Error, it shall immediately investigate and effect the appropriate corrections to the processed transaction, and shall notify the User in writing of the results within two (2) weeks from the date when it receives the request or becomes aware of the Error. However, the Company may notify the User by phone, email or other means if the mailing address of the User is unknown or upon request from the User.

Article 7 (Generation and Retention of EFT records)

1) The Company will generate and retain records, from which the User can track or search details of the User’s EFTs, or from which any Error in EFT details, if found, can be checked or corrected.

2) Types of, and method of retention for, the records to be retained by the Company under Paragraph 1) shall be subject to Paragraphs 3) and 4) of Article 5 hereof.

Article 8 (Cancellation of Transaction Request)

1) A User who has entered into an Electronic Payment Transaction may cancel his/her Transaction Request at any time prior to when the payment becomes effective, by transmitting an electronic document (including email) to the relevant contact person provided in Paragraph 5) of Article 5 above. The cancellation requests for each of the services shall take effect at the time set forth in Article 16 and Article 21.

2) If the payment has already become effective, then the User may receive a refund for his/her payment that may vary depending on the method of cancellation under applicable laws such as the Act on the Consumer Protection in Electronic Commerce Transactions (the “e-commerce Act”).

Article 9 (Prohibition on the Provision of EFT Data)

Except as provided by laws and regulations such as the Act on Real Name Financial Transaction and Confidentiality, or without the consent of the User himself/herself, the Company shall neither provide or disclose to any third party, nor use for any purpose other than its business purposes, any information or data regarding the personal matter or account of the User, the Means of Access, or the contents or records of and the EFT (each, acquired by it in connection with providing EFT Services).

Article 10 (Liability of the Company)

1) The Company shall compensate the User for any loss or damage he/she suffers as a result of forgery or alteration of the Means of Access (provided that the Company is the entity responsible for issuing, using, or managing the Means of Access), or in the course of electronically transmitting or processing the execution of a contract or the Transaction Request.

2) Notwithstanding Paragraph 1) above, the Company shall not be liable for any loss or damage incurred in any of the following cases:

1. if the User suffers the loss or damage as a result of forgery or alteration of the Means of Access issued by a party other than the Company;

2. if the User lends, delegates the use thereof, or assigns or provides as security, the Means of Access to a third party, or if the User divulges or discloses a Means of Access or neglects or leaves the Means of Access unattended although the User knew or could have known that a third party may make an EFT by using the User’s Means of Access without authorization; or

3. if the User who is a corporation (excluding small enterprises as set forth in Article 2, Section 2 of the Framework Act on Small and Medium Enterprises) suffers the loss or damage but the Company has fulfilled its duty of due care as reasonably requested, such as establishment of, and thorough compliance with, security procedures in order to prevent an accident.

3) Notwithstanding the User’s Transaction Request, the Company may temporarily interrupt the provision of the EFT Services for the maintenance, replacement or failure of the Company’s information & communications system (e.g. computers), disruption of telecommunications services or the like. In such case, it shall compensate the User for any loss or damage s/he suffers as a result of such temporary suspension.

4) Notwithstanding Paragraph 3), the Company shall not be liable for any loss or damage incurred by the delay of or failure to process the EFT Services in the case of a force majeure event (such as stoppage of power supply, fire, network interference, or any other events beyond its reasonable control and not attributable to the Company); provided that the Company has provided the User with notification of the reason for such delay or failure (including notification provided to the User by financial institutions, issuers of means of payment, and online/mail-order sellers) or has proved that there was no willful misconduct or negligence on the part of the Company.

5) The Company may temporarily interrupt the provision of the EFT Services for the maintenance, replacement or the like of the Company’s information & communications system (e.g. computers). The Company shall notify the Users in advance of the interruption of the EFT Services and reasons for the interruption on the Auction Site and the Beautyshop Site (as the case may be).

Article 11 (Dispute Resolution and Mediation)

1) In respect to EFTs, Users may raise opinions or complaints, or request dispute resolution for damage claims, to the persons specified on the bottom of the main pages of the Auction Site or the Beautyshop Site (as the case may be).

2) Any User may file an application for dispute resolution in writing (including electronic documents) or by using an Electronic Device, to the Company’s headquarter or business office pursuant to Paragraph 1) above, and the Company shall notify the User of the results of its investigation or the resolution of the dispute within fifteen (15) days.

3) The User may, if s/he has any objection regarding the results of the Company’s dispute resolution, apply for mediation with either the Financial Disputes Mediation Committee of the Financial Services Commission pursuant to the Act on the Establishment of the Financial Services Commission, or the Consumers Dispute Settlement Commission of the Korea Consumer Agency pursuant to the Framework Act on Consumers, in connection with a dispute related to using the EFT Services of the Company.

Article 12 (Company’s Duty of Security)

In furtherance of ensuring security and reliability for each type of EFT, the Company will perform its fiduciary duty and comply with the standards set forth by the Financial Services Commission in relation to the Electronic Financial Business and information technology, e.g., personnel, facilities, and the Electronic Devices used for electronic transmission or processing that may vary depending on the type of EFT.

Article 13 (Other Rules to Comply with)

Any matters (including definitions of terms) not set forth herein shall be governed by separate terms and conditions and consumer protection laws such as the EFTA, the e-commerce Act and the Specialized Credit Financial Business Act.

Article 14 (Jurisdiction)

Jurisdiction over any dispute between the Company and the User shall be determined by the Civil Procedure Act.

Chapter 2. e-Payment Gateway Services

Article 15 (Definitions)

Capitalized terms used in this Chapter shall be defined as follows:

1. “e-Payment Gateway Services” means with respect to the electronic purchase of a product or service, a service of transmitting or receiving payment information, or agency or intermediation service for the settlement of such consideration.

2. “User” shall mean a person who agrees to the TOU and uses the e-Payment Gateway Services provided by the Company.

Article 16 (Cancellation of Transaction Request)

1) A User who has used the e-Payment Gateway Services may withdraw his/her Transaction Request at any time before the amount of the Transaction Request is (i) recorded in the account ledger of either the Company or the financial institution where the Payee’s account is established, or (ii) entered in the Electronic Device.

2) The Company must return the received payment to the User, if the User has successfully withdrawn the Transaction Request and thereby no transaction requiring the payment has been entered into.

Article 17 (Management of Means of Access)

1) The Company, in the course of providing the e-Payment Gateway Services, shall select the Means of Access and check the User’s identity, authority and contents of the Transaction Request and the like.

2) Except as particularly provided by laws and regulations, the User shall not commit any of the following actions in using the Means of Access:

1. Assign the Means of Access to a third party or be assigned the Means of Access by a third party,

2. Lend or grant use of the Means of Access to a third party;

3. Grant a pledge or other security interest in the Means of Access to a third party; and

4. Broker any of the actions described in Paragraphs 1 through 3.

3) The User shall not divulge or disclose his/her Means of Access to a third party, or neglect or leave the Means of Access unattended, and shall use reasonable caution to prevent theft, forgery or falsification of the Means of Access.

4) Upon receiving the User’s notice of theft, loss or the like of his/her Means of Access, the Company shall be liable for losses or damages suffered or sustained by the User arising from a third party's use of the Means of Access thereafter.

Chapter 3. Payment Escrow Services

Article 18 (Definitions)

1) Capitalized terms used in this Chapter shall be defined as follows:

1. “Payment Escrow Services” shall mean a service where, in respect of a Prepaid Mail-order Sale made on the Auction Site or the Beautyshop Site, a consumer’s payment for a product or service (collectively the “Products etc.”) is kept by the Company in escrow until the shipment is completed, after which the payment is made to the Seller.

2. “Prepaid Mail-order Sale” shall mean a mail-order(online) sale where the Consumer makes full or partial payment prior to receiving the Products etc.

3. “Seller” shall mean a person who agrees to the TOU, opens a store on the Auction or Beautyshop Site operated by the Company, and is engaged in mail-order(online) sale business.

4. “Consumer” shall mean a person who agrees to the TOU and purchases the Products etc. from the Seller (with a store on the Auction or Beautyshop Site operated by the Company), and falls under the definition provided in Article 2 Section 5 of the e-commerce Act.

5. “User” shall mean the Seller and the Consumer.

Article 19 (Release of Payment in Escrow)

1) The Consumer (including persons to be receiving the Products etc., if such Consumer consented thereto; the same applies to Paragraphs 2) and 3) below) must notify the Company of his or her receipt of the Products etc. within three (3) business days therefrom.

2) Upon receiving the Consumer’s notice of receipt of the Products etc., the Company shall release the payment to Seller at a time no later than the date specified by the Company.

3) In the event the Consumer fails to notify the Company of his/her receipt of the Products etc. within three (3) business days therefrom without providing a reasonable explanation, the Company may thereafter release the payment to the Seller without the Consumer’s consent.

4) The Company must return the payment to the Consumer if circumstances arise where the Consumer becomes entitled to a refund of the payment before the Company releases the payment to the Seller.

Article 20 (Cancellation of Transaction Request)

1) A User who has used the Payment Escrow Services may withdraw his/her Transaction Request at any time before information on the amount of Transaction Request has reached the Electronic Device designated by the Payee.

2) The Company must return the received payment to the User if the User has successfully withdrawn the Transaction Request and thereby no transaction requiring the payment has been entered into.

Article 21 (Mutatis Mutandis Application)

Article 17 of Chapter 2 hereof (e-Payment Gateway Service) shall apply mutatis mutandis to the Payment Escrow Service provided in this Chapter.

Chapter 4. Electronic Pre-payment Means

Article 22 (Definitions)

Capitalized terms used in this Chapter shall be defined as follows:

1. “Electronic Pre-payment Means” refers to a medium of payment regulated by the EFTA and issued by the Company after prior notice to the User, such as e-Money (Auction) or Mileage (Beautyshop), which can be used to pay for a product or service.

2. “e-Money” shall mean Electronic Pre-payment Means issued and managed by the Company that are used by the User to pay for the purchase of products or services.

3. “Cash Balance” shall mean a virtual account service provided on the Beautyshop Site, whereby the amount paid by the User in excess of the actual payment amount (difference in deposit), the amount that is to be returned to the User for reasons of cancellation prior to confirming payment (deposit refund), the amount that is to be returned to the User for reasons of purchase cancellation or return after an order is placed, and the like are aggregated and accumulated in such virtual account. The maximum Cash Balance allowed is KRW 2 million for named accounts and KRW 500,000 for anonymous accounts.

4. “User” means a person who agrees to the TOU, purchases the Products etc. from the Seller and uses Electronic Pre-payment Means to make a payment therefor.

5. “Seller” shall mean a person who sells products or services to the User and accepts the Electronic Pre-payment Means in return for the products or services sold to the User.

6. “Means of Access” refers to the User Numbers and Passwords registered with the Company or any other means designated by the Company to ensure authenticity and accuracy of the User and the details of transactions or make a Transaction Request for an EFT using Electronic Pre-payment Means.

Article 23 (Managing Means of Access)

1) The Company shall not take responsibility for any loss of stored value that occurs prior to receiving a User’s notice of loss, theft, or the like of the Electronic Pre-payment Means or Means of Access.

2) Paragraphs 1 through 3 of Article 17 of Chapter 2 (e-Payment Gateway Services) shall apply mutatis mutandis to the Electronic Pre-payment Means provided in this Chapter (Chapter 4. Electronic Pre-payment Means).

Article 24 (Refunds)

The User may request, and subsequently receive, a full refund for any Electronic Pre-payment Means s/he owns. However, only the Electronic Pre-payment Means that the User purchased from the Company and owns may be refunded, and not those that were provided by the Company at no cost through sweepstakes or otherwise.

Article 25 (Expiration Date)

1) The Company may set an expiration date for the Electronic Pre-Payment Means that it provides to Users at no cost through events such as sweepstakes, and the User may only use these said Electronic Pre-Payment Means until the pre-determined expiration date.

2) The Company shall provide prior notification on the Auction Site and the Beautyshop Site (as the case may be) used for such events, to Users regarding the expiration dates, if any, of the Electronic Pre-Payment Means.

Article 26 (Cancellation of Transaction Request)

1) The User may cancel his/her Transaction Request at any time prior to the Payee’s receipt of data on the monetary amount of the requested transaction, if the User utilizes the Electronic Pre-Payment Means.

2) The Company shall return any received payments if the User has successfully withdrawn the Transaction Request and thereby no transaction requiring the payment has been entered into.

Article 27 (Retraction and Negative Balance of Electronic Pre-Payment Means)

1) In case of cancellation of purchase by Electronic Pre-Payment Means, any Electronic Pre-Payment Means accumulated from such purchase by the User may be retracted by the Company.

2) In the event the Company, due to certain circumstances (such as purchase cancellation by the User) retracts the Electronic Pre-Payment Means already given to the User, the Company may establish a negative balance of the Electronic Pre-Payment Means below zero if the User’s account balance is less than the amount of Electronic Pre-Payment Means to be retracted, in which case the User may recover such Electronic Pre-Payment Means through additional purchases, by making a cash payment to replenish his/her account, or otherwise.

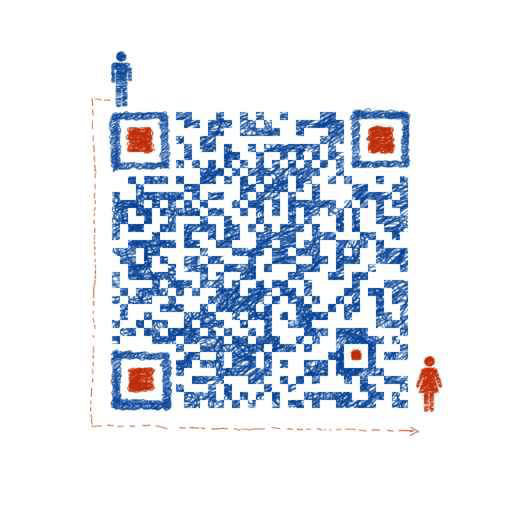

WeChat QRcode scanning

WeChat QRcode scanning